The Augmented Dickey-Fuller Test was used to assess stationarity.

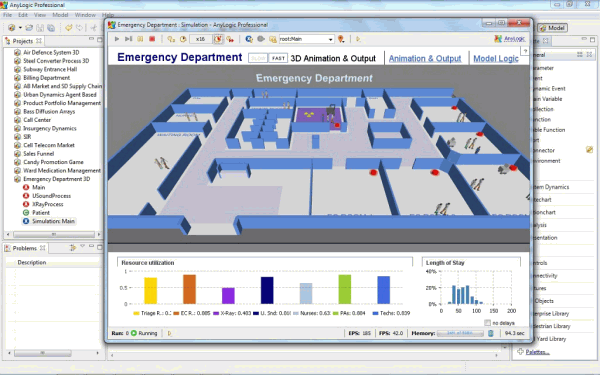

#Anylogic price series#

Preliminariesīefore delving into the results, I want to take a moment to discuss a few overarching statistical concepts that pervade the rest of the article - stationarity, time series validation, and one-step ahead forecasting.Įthereum closing prices (blue) and differenced closing prices (red), standardized for the sake of visualization. In the time that I spent tinkering with various models/algorithms, the Ethereum market has grown so rapidly that I could probably stand to append more recent data to what I have here (my dataset only goes a week or so into December 2017), but for now, we will work with what I have on hand. I chose to use Bitcoin’s relative, Ethereum, which is gaining more popularity with each passing day. In the rest of the blog, I will detail my adventure through time series analysis/forecasting using ARIMA, random forest, and long short-term memory ( LSTM) networks to predict closing prices.

A value of 1 means that the closing price was the same as the high price in that hour across all exchanges, whereas a 0 occurs when it closes at the low price across all exchanges. relative_hl_close: additional measure of volatility min-max scaling of closing price using high/low prices (averaged over exchanges).

#Anylogic price free#

The only downside, however, is that when using their API with a free account, one only has access to the 2000 most recent time points (~3 months of hourly data). I found working their API/documentation very simple, and the fact that they are integrated with 75+ different exchanges made it a one-stop shop for me. Without further ado, let’s begin! Data Sourcesįor this work, I obtained hourly cryptocurrency data via the CryptoCompare API ( ). (Additionally, this project has given me an excuse to sink my teeth into time series analysis/forecasting, which I detail in a set of notes here.) Due to the many different factors driving the market (supply/demand, media hype and/or public perception, coin utility, etc.), this may seem like a Sisyphean endeavor, but as we will see, one can generate halfway decent forecasts even with models that skimp on computational expense.

In this post, I’ll use a couple of different algorithms to see if it’s possible to make reliable predictions for hourly cryptocurrency prices using only “traditional” cryptocurrency market data (opening/close prices, high/low prices, volume). With all of the buzz about, I began to wonder - is there any logic to the market? Could yesterday’s (or even the last hour’s) market dynamics be used to predict future performance? With those questions in mind, I set out to see if there was any signal in the noise. Each day, there seem to be new reports of various cryptos reaching “all-time highs”, economists prophesying the proverbial crypto bubble burst, and new players (I’m looking at you, Ripple) shaking up the market. The frenetic hype surrounding cryptocurrency is unlike anything that I have witnessed in my two and a half decades on this planet (perhaps with the exception of the rise of Crazy Bones, which were quite the status symbol during my years in elementary school).

0 kommentar(er)

0 kommentar(er)